modified business tax rate nevada

Nevada levies a Modified Business Tax MBT on payroll wages. Nevada has a 685 percent sales tax rate and a max local rate of 153 percent with an average.

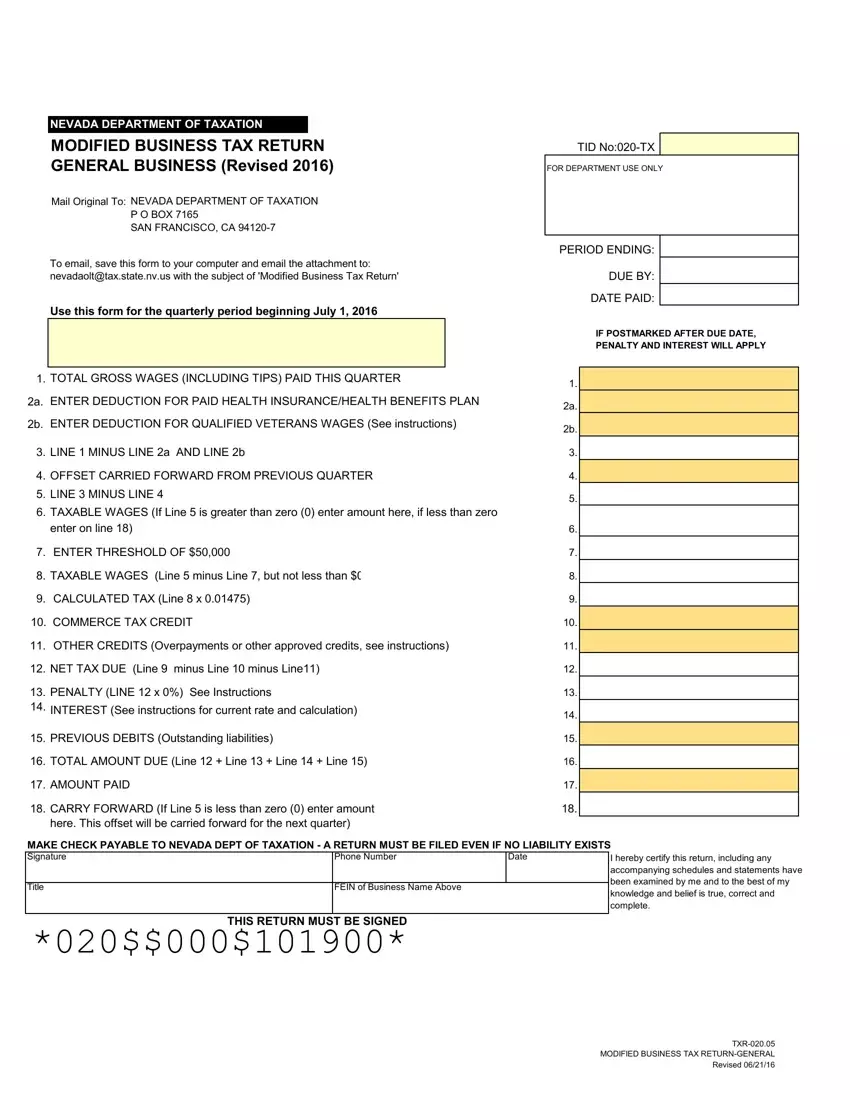

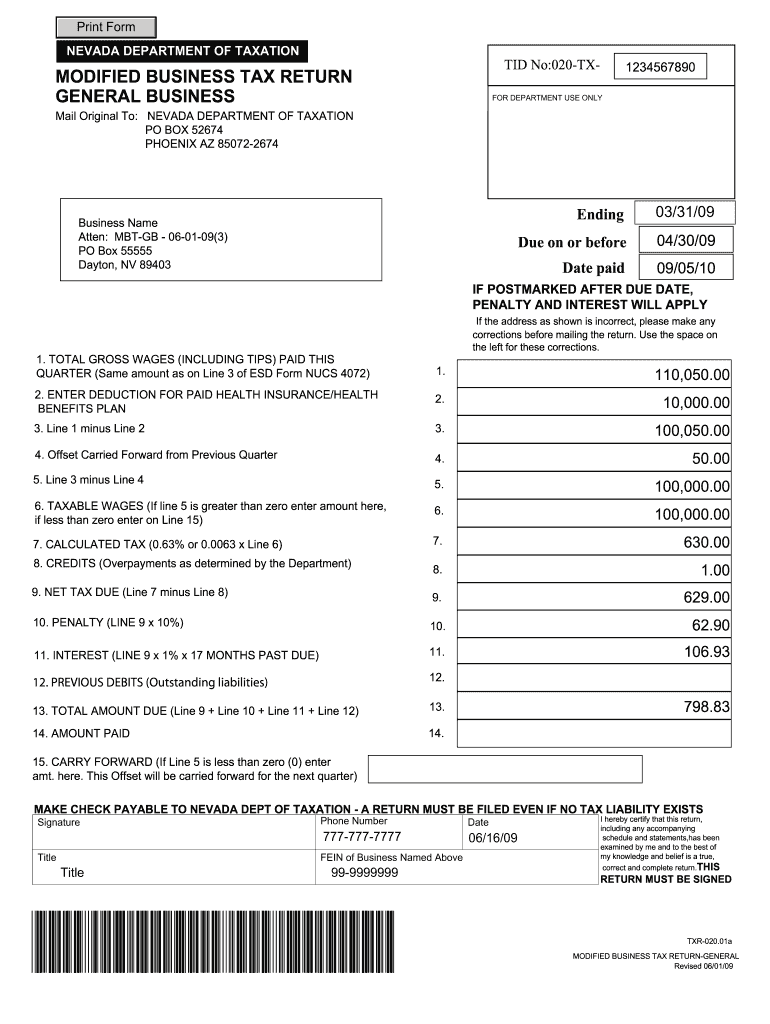

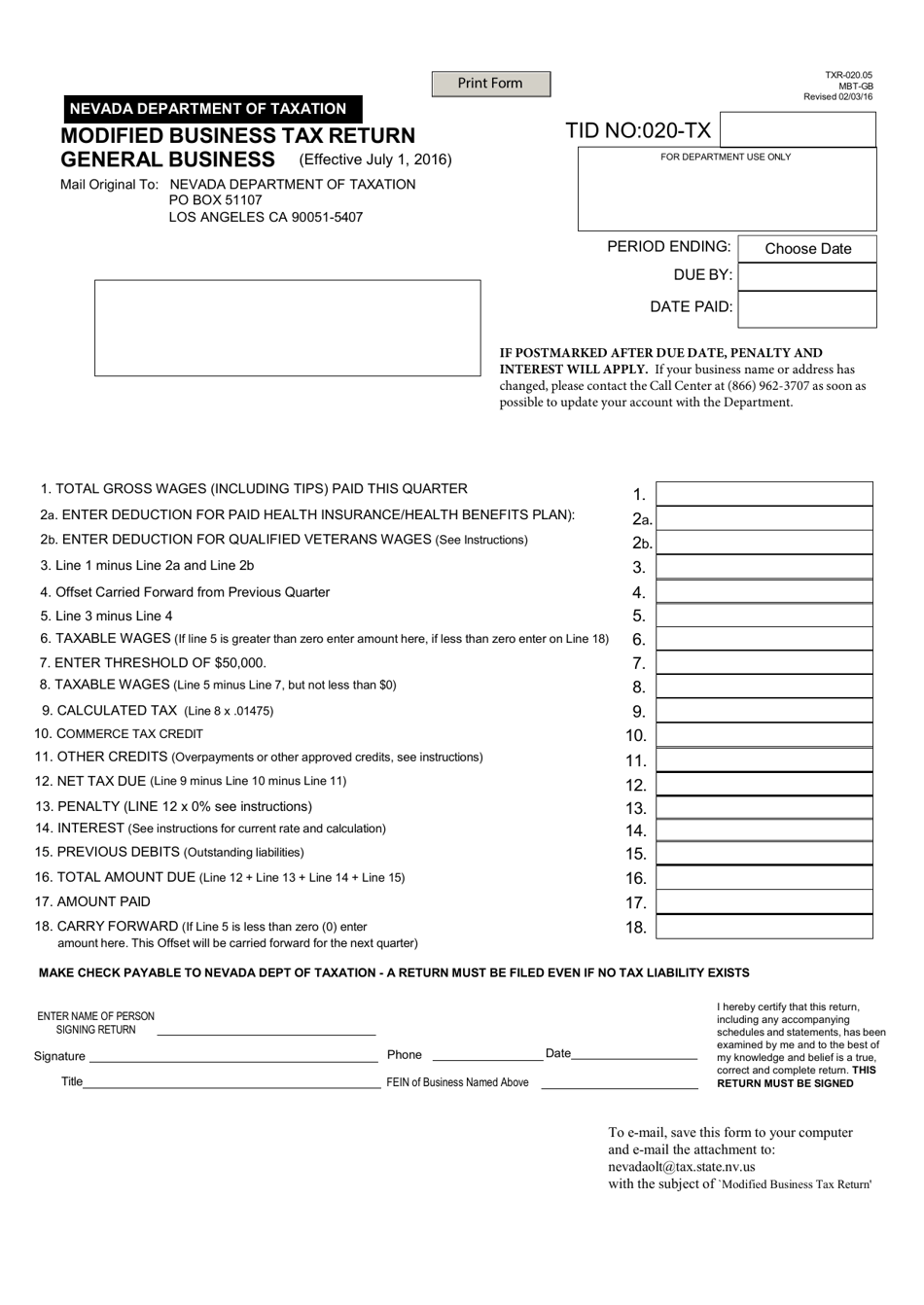

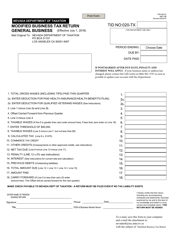

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Imposition - A excise tax at the rate of 2 of the wages paid by the employer during a calendar quarter.

. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries. MODIFIED BUSINESS TAX Nevada Higher Education Prepaid Tuition Program NRS 353B An employer is.

Nevada Modified Business Tax Rate. Employers subject to Nevada Unemployment are also subject to the Modified Business Tax on total gross wages less employee health care benefits paid by the employer. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019.

Nevadas corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Nevada. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165. Modified Business Tax Statistics Please note the following figures are based on tax-paying businesses only and are not a complete representation of total Nevada gross wages Quarterly.

The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. According to the court a bill that was passed during. The Nevada Department of Taxation DOT is.

The bill would have created a digital goods tax that is like the states retail sales tax. The new Modified Business Tax rates for FY20 as calculated pursuant to NRS 360203 are 1378for general business and 1853 for mining and financial institutions. The General Modified Business tax rate was increased to 1475 of net payroll.

Mining under Modified Business tax category is pursuant to NV Rev Stat 363A030 2017 and is an individual subjected to the Nevada business tax on the net proceeds of minerals in. A Nevada Employer is defined as per NRS 363B030. For the Commerce Tax year ended June 30 2016 a business was able to pay the.

What is the Nevada Modified Business Tax. The Commerce Tax credit the business can apply to the Modified Business Tax liability is 100. Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the.

For additional questions about the Nevada Modified Business Tax see the following page from the. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when. The Nevada Modified Business Tax MBT is a tax on businesses with gross revenues of more than 4 million per year.

The Nevada Supreme Court recently held that a Nevada law that repealed a previously legislated reduction of the Modified Business Tax MBT rate was unconstitutionally enacted.

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Slt Nevada S New Tax Revenue Plan The Cpa Journal

Nevada Commerce Tax What You Need To Know Sage International Inc

What Is The Business Tax Rate In Nevada

Nevada Taxes Will The Tax Man Cometh To Carson City In 2023 Nbm

First Round Of Nevada Modified Business Tax Refunds Issued Serving Northern Nevada

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Nevada Mbt Fill Online Printable Fillable Blank Pdffiller

Form Txr 020 05 Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller

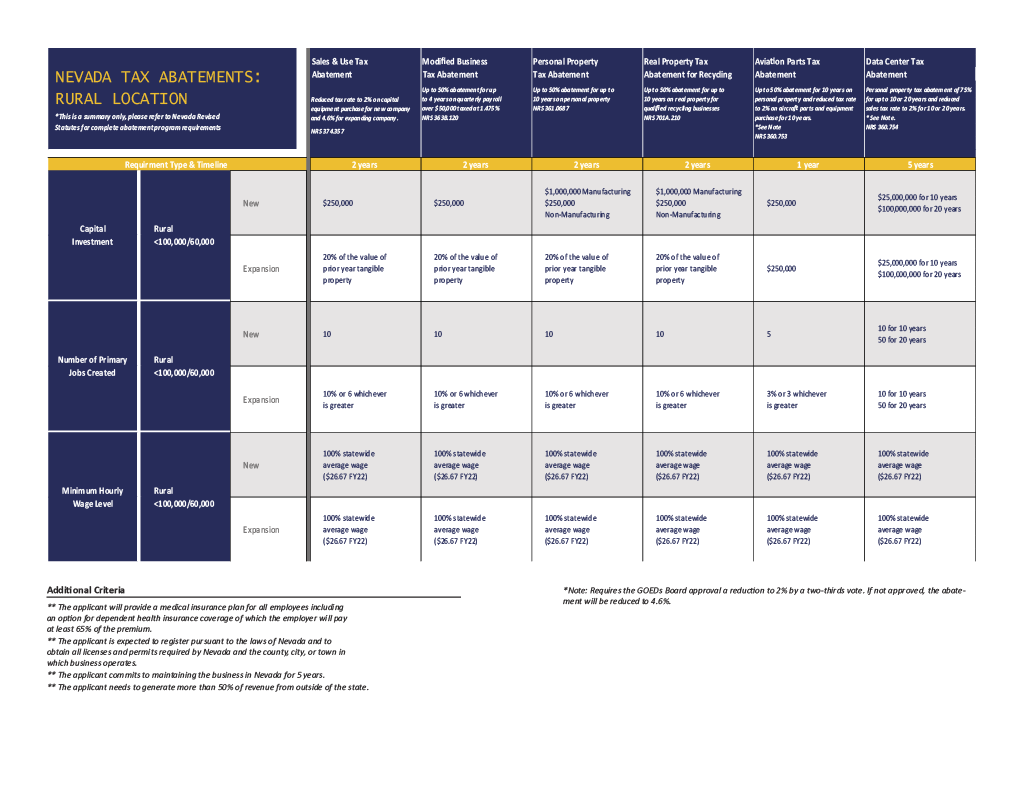

Business Friendly Nevada Northern Nevada Development Authority

Does Qb Offer The Nv Modified Business Tax Payroll Form

Form Txr 020 05 Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller